Table Of Content

- What will happen if the housing market crashes?

- Developers squeeze in lots of style for unique Jacksonville Beach 'skinny house' on sale

- Is It a Good Time to Sell a House in California?

- Ongoing Affordability Challenges Could Throw Cold Water on Spring Home-Buying Hopes

- NAR Settlement Rocks the Residential Real Estate Industry

Kings, Stanislaus, and Yuba followed closely, registering a six-point decrease in affordability. – Fresno, a major city in the San Joaquin Valley, showcases potential for home price appreciation in the forecasted period. – Riverside, located in the Inland Empire region, showcases steady growth potential in its housing market. Generally, a balanced market will lie somewhere between four and six months of supply. Inventory is calculated monthly by taking a count of the number of active listings and pending sales on the last day of the month.

What will happen if the housing market crashes?

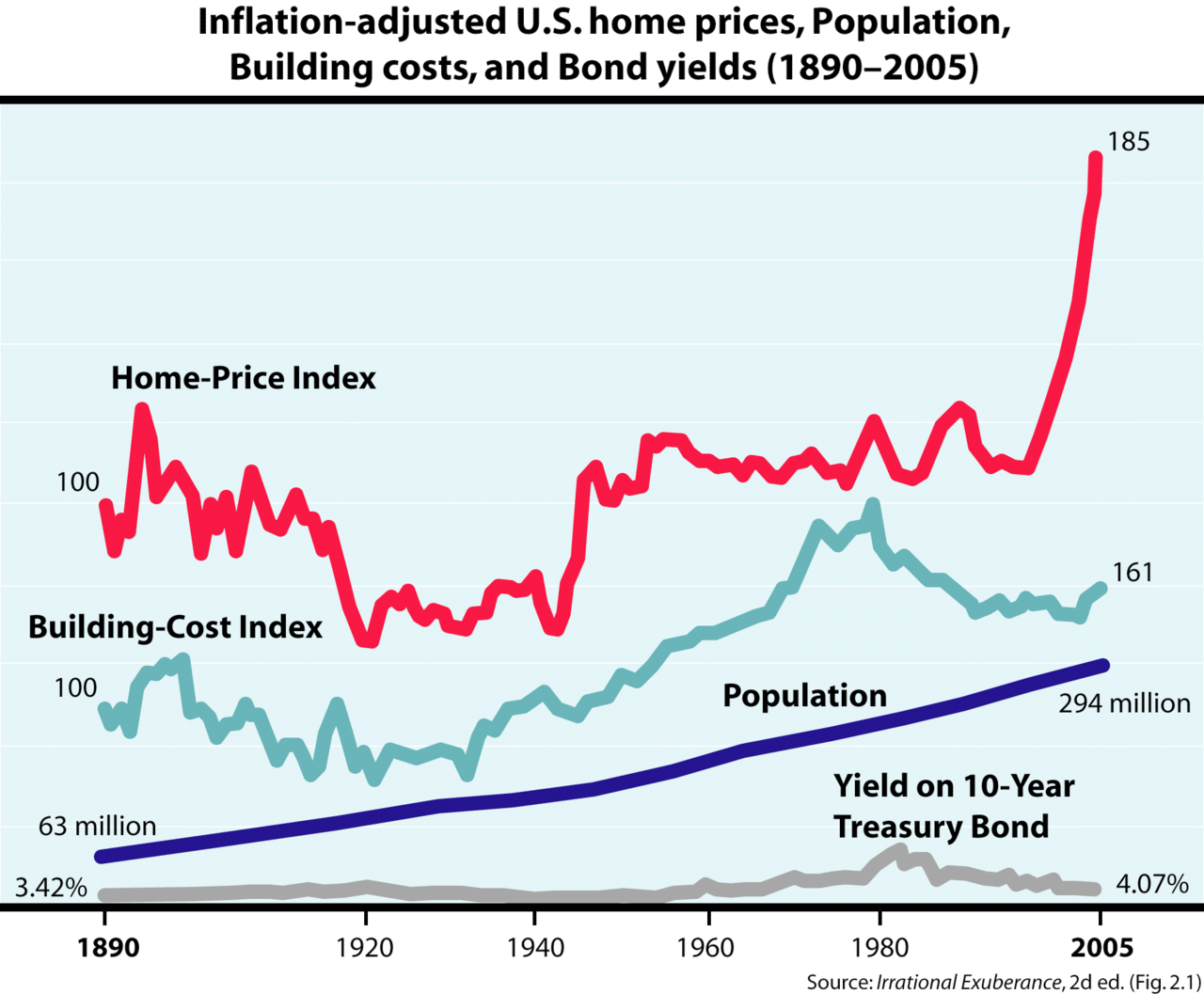

Even so, still-high mortgage rates and home prices amid historically low housing stock continue to put homeownership out of reach for many. The data illustrates a median sale-to-list price ratio of 100%, indicating that homes in Los Angeles County, CA generally sold for around the asking price during March 2024. The California real estate market remains seller-friendly, but buyers are regaining bargaining power as the local markets rebalance as 2023 continues. While sellers in many counties are more likely to slash asking prices and see their homes remain longer on the market, buyer demand and prices should remain steady and will remain a seller’s market or a neutral market. “Real estate has traditionally been a ‘holder of value’ more than a high-return investment. The exceptions to this occurred in the real estate boom/bust where easy money drove speculative behavior that blew up on the investors and the U.S. economy.

Developers squeeze in lots of style for unique Jacksonville Beach 'skinny house' on sale

Still subject to court approval, the settlement requires changes to broker commissions that will upend the buying and selling model that has been in place for years. The majority of median sales prices across California decreased between 2022 and 2023. These are the recent median sold price readings from the California Association of Realtors (CAR) for existing single-family home real estate transactions.

Is It a Good Time to Sell a House in California?

The median rent for a one-bedroom apartment in California stood at $2,016 last month, reflecting the overall trend in the region. While inventory is increasing, the highest reading within the last five years was in January 2019 with four months of supply. Many homes in Los Angeles are selling fast, if you're buying plan to act quickly.

When it comes to the real estate market, one crucial factor to consider is whether it favors sellers or buyers. A seller's market indicates that there is more demand from buyers than the available supply of homes. In March 2024, home prices were up 6.3% compared to last year, selling for a median price of $1.1M. On average, homes in sell after 29 days on the market compared to 50 days last year. It’s a never-ending tug-of-war between house hunters seeking a place to live and others looking for investment properties. Low homebuying affordability puts a focus on investors — especially big-money giants — and their role in rising home prices.

San Francisco Buyers Bring Its Luxury Housing Market Back to Life - The Wall Street Journal

San Francisco Buyers Bring Its Luxury Housing Market Back to Life.

Posted: Fri, 26 Apr 2024 01:00:00 GMT [source]

"The foundation for such a narrow house had to be much larger than normal. We had to think about tipping over in high winds," Atkins said. "There is a complete truckload of concrete — 40,000 pounds — in the foundation at each end of the house to counteract hurricane-force winds." Given the storm-prone nature of the beachside community, construction required a few special considerations. The Redfin Compete Score rates how competitive an area is on a scale of 0 to 100, where 100 is the most competitive. Bankers are still scarred by the Great Recession and have been quick to pull back lending activities with recent discovery of risks. But there are not-in-my-backyard opponents who think new residences should be far from their current homes.

NAR Settlement Rocks the Residential Real Estate Industry

It is one of the most significant housing markets in the United States, characterized by its substantial size and considerable economic influence. While homes are remaining on the market longer and price reductions are becoming more common, inventory is still tight and a fair number of homes continue selling above asking price. For now, the relative lack of homes for sale is a favorable factor for sellers. CAR forecasts an overall reduction in existing home sales and median prices for 2023. Upon entry, the view is straight through the living area and kitchen to the backyard, putting one in mind of the famed "shotgun" houses of New Orleans, although this version has two levels. The compact layout may also recall the tiny home movement, often hailed as a solution to the affordable housing crisis.

March saw a slight slowdown, with existing single-family home sales at 267,470, a 7.8% decrease from February. This dip marks the first year-over-year decline in three months, following January and February's increases. Recent months have shown some resilience, but higher rates might cool housing activity in the short term. However, Mr. Levine maintains an optimistic outlook, suggesting a rebound once the market adjusts to evolving economic factors like inflation.

However, there are still only 2.9 months of inventory at the current sales pace. NAR denies any wrongdoing and maintains that its current policies benefit buyers and sellers. The organization believes it’s not liable for seller claims related to broker commissions, stating that it has never set commissions and that commissions have always been negotiable.

"This is already evident in some high-profile U.S. office markets and, increasingly, in gateway European cities with rising vacancies." The most important thing for buyers entering this new market, experts told me, is to read the buyer-agency contract carefully or consider hiring a lawyer if you have concerns. Realtors may rely on templates handed down from their state associations, but the terms aren't ironclad. His biggest stories have highlighted the challenges for millennial homebuyers, the rise of the single-family-rental industry, and how the "Airbnbust" will lead to heavier regulation of short-term rentals. Sales performance varied across regions, with some experiencing growth and others facing declines. For instance, the Central Coast region saw a notable 7.2% year-over-year increase in sales, while the Central Valley region experienced a decline of -9.6% compared to the previous year.

As the year unfolds, actual market performance will provide a clearer picture of these predictions' accuracy. Regardless, this information offers valuable insights for both home buyers and sellers navigating the market in the coming year. The direction and pace at which home prices are changing are indicators of the strength of the housing market and whether homes are becoming more or less affordable. Rising mortgage rates are slowing the housing market, prompting some analysts to say home prices will decline. For one, the data uncovered that expenses are eating up more than 32% of the average national wage.

– San Luis Obispo, situated along California's central coast, showcases potential for home price appreciation in the forecasted period. The median home price in California for March skyrocketed to $854,490, a significant 6.0% jump from February and a robust 7.7% increase year-over-year. This marks the ninth consecutive month of annual price growth, highlighting the ongoing strength of the state's housing market even amidst economic shifts. The median days on market for homes in Los Angeles County, CA averaged 40 days during March 2024. This metric indicates the typical duration it takes for a property to sell after being listed. Over the past year, the trend for median days on market has shown a slight decline, indicating potentially increased demand or more efficient sales processes.

The primary reason for the housing slowdown is that mortgage rates have soared this year, from the low 3% range to the mid-5% range, where they are today. Use a mortgage calculator to estimate your monthly housing costs based on your down. But if you’re trying to predict what might happen next year, experts say this is probably not the best home-buying strategy.

– Bakersfield, situated in California's Central Valley, emerges as another area poised for home price growth. – San Diego, renowned for its pleasant climate and diverse communities, remains a sought-after destination for homebuyers. A significant pricing factor occurs when looking for the best mortgage rates.

No comments:

Post a Comment